by Clearpoint Wealth Management | Mar 28, 2018 | Blog, Uncategorized

Garlic Rosemary Ribeye Ingredients N 2 ribeye steaks, 1.5 inches thick N 4 cloves of garlic, minced N 2 tablespoons fresh rosemary, chopped N Salt and pepper to taste N Olive oil for brushing 2-3 Servings } 15min Prep } 20min Cook } 35min Total Prep Transform your...

by Clearpoint Wealth Management | Mar 7, 2018 | Blog, Uncategorized

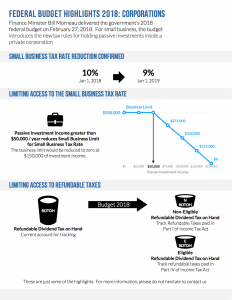

2018 Federal Budget Highlights for Business The government’s 2018 federal budget focuses on a number of tax tightening measures for business owners. It introduces a new regime for holding passive investments inside a Canadian Controlled Private Corporation (CCPC)....

by Clearpoint Wealth Management | Feb 20, 2018 | Blog, Uncategorized

My kids love presents. You see their eyes light up every time Christmas comes or it’s another birthday. They are even happiest when they get something new from the store! Funny thing is, over time, if you ask me what Joshua or Lukas got for their birthdays a few...

by Clearpoint Wealth Management | Jan 29, 2018 | Blog, Uncategorized

5 Reasons for an RRSP There are some great reasons to open a Registered Retirement Savings Plan (RRSP) to save for your retirement. Here are the top 5 reasons to open an RRSP: Contributions are tax deductible You can claim your RRSP contribution as a deduction on your...

by Clearpoint Wealth Management | Aug 3, 2016 | Blog, Uncategorized

In our lastest video, we talk about the best way to purchase mortgage insurance, outlining the difference between purchasing this from the bank and an advisor....

by Clearpoint Wealth Management | Jul 7, 2016 | Blog, Uncategorized

Welcome to Clearpoint Wealth Management. Our goal is to work with you to achieve your financial goals by providing a fresh approach to your finances. We pride ourselves in partnering with very well known financial and insurance institutions to get you the best...